Our Expert Team Will Get Your Disaster Loan Approved Fast!

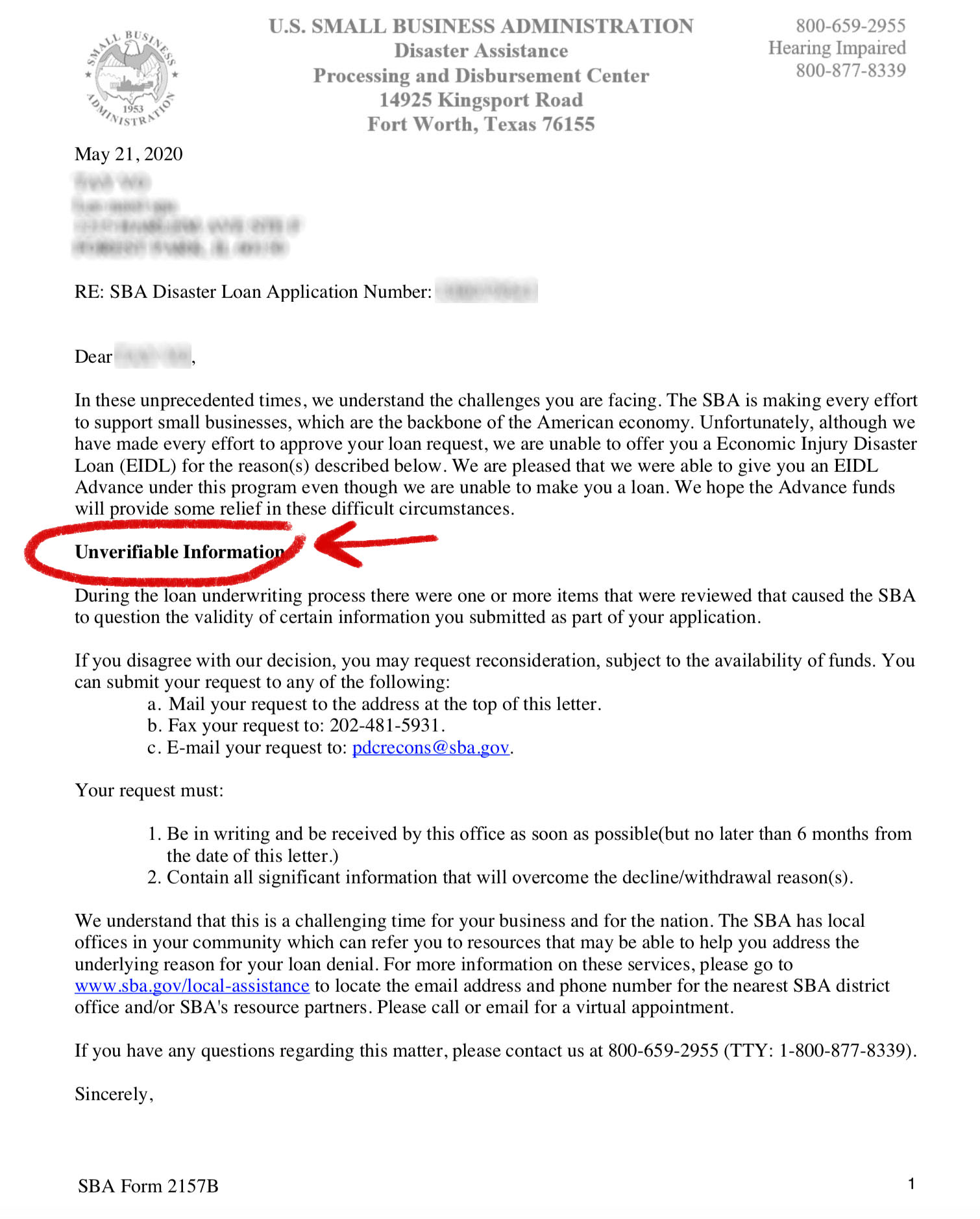

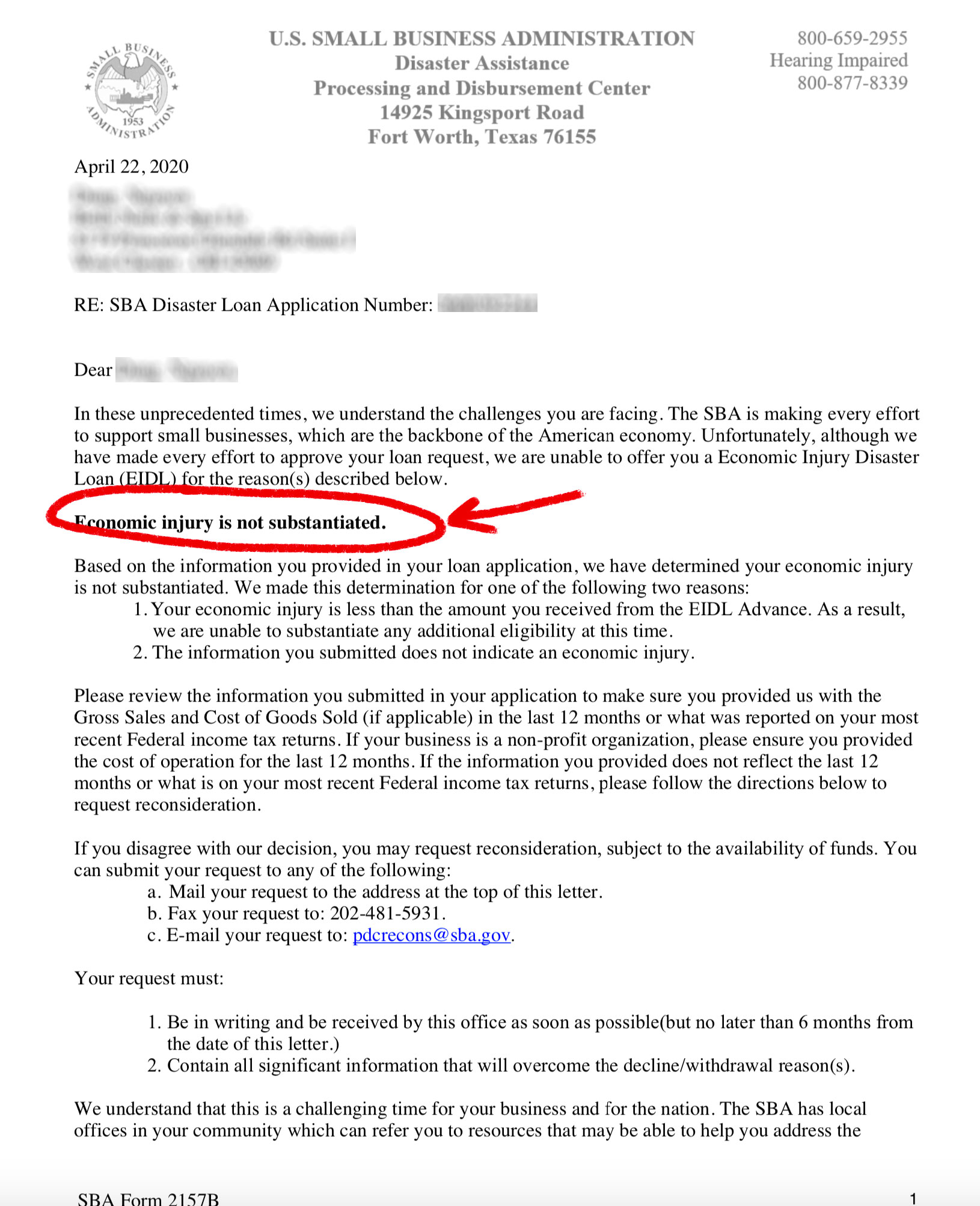

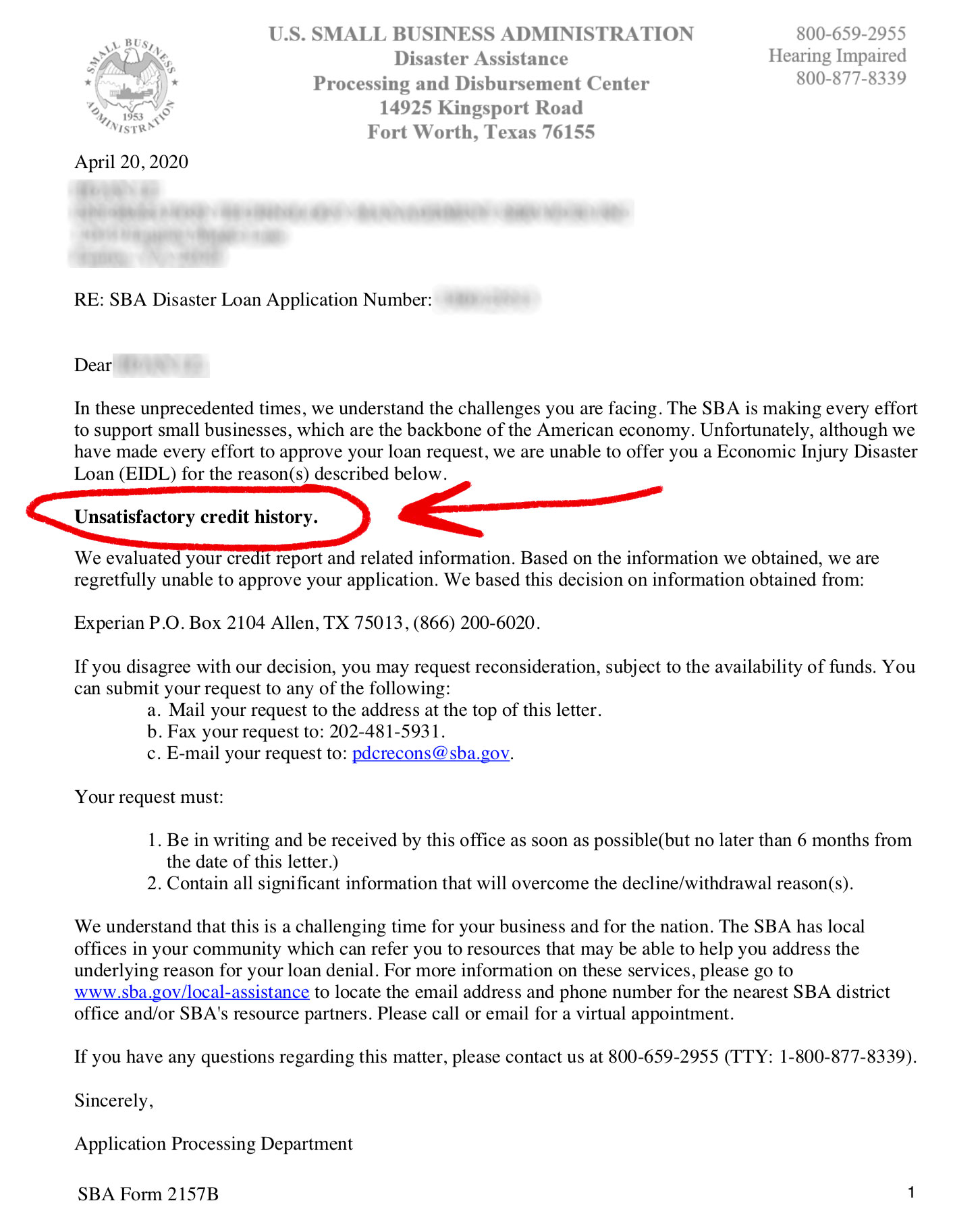

Has Your EIDL Application Been Rejected by the SBA for Any of the Following Reasons?

- Unsatisfactory Credit History

- Economic Loss Not Substantiated

- Unverifiable Information, OR...

- Approved - BUT at a lower limit than you should qualify for

Don't Lose Hope... Our SBA Experts Are Standing By to Help You.

Our Proprietary Process removes all the stress and confusion by streamlining the entire SBA Application Approval Process. Take advantage NOW!

* Disaster Loan Packaging is not affiliated with the SBA or any other government or federal agency. Disaster Loan Packaging is a private third-party loan preparation and packaging company.

$10,000 Forgivable Grant

Loan Amount up to $2 Million

Low Fixed Rate of 3.75%

Up to 30 Years Loan Term

First Payment in 12 Months

EIDL APPLICATION DECLINED?

Did You Receive a "Decline Letter" From The SBA Like One Of These?

Or, perhaps you were approved for your EIDL Loan but approved for a much lower amount than you felt your business should qualify for. We understand! Our team can help you get your EIDL funding you deserve during these hard economic times.

Get immediate help from our team of experts to expedite your loan processing and approval

PROBLEMS AND DELAYS...

You Thought You Did Everything Correctly...

- Your business suffered due to Coronavirus COVIC-19 Pandemic

- You applied for the SBA - Economic Injury Disaster Loan called EIDL that promised to fund you 6 months of your business operating capital with a quick $10,000 in grant for Emergency Fund.

- You are now being requested to fill out 7 sets of different forms along with last year tax return or financial.

- You're now frustrated, and you should because:

- You're overwhelmed by these series of questions (400 of them to be exact) – some of them are quite complicated

- You realize that this will take a professional like your CPA or someone with real financial experience to assist you.

- If your application packet is incomplete, it will be set aside. You'll be notified of what is missing and your application will remain in the processing until all the necessary information is received. YOU WILL THEN GO TO THE END OF THE QUEUE.

- The SBA is understaffed and there are 10's of millions of applications they are dealing with.

- One missing document or incomplete package can cost you weeks of wait time thus delaying the funding that your business desperately needs

The Solution

Disaster Loan Packaging Can Help Expedite Your Loan Processing or Help You Turn a Decline Into an Approval

Phase 2 is coming! The SBA will be requesting proof with supporting documents to get your loan approved. Our expert team and proprietary loan document generator will streamline this process for you.

- Fill out all forms completely and precisely

- Write a hardship letter to best state your case

- Include relevant supporting documents

- Organize your package in a systematic way that would make sense to any SBA processor or decision-maker.

- And finally, submit the package to the right place via Fax, Email and Certified Mail with Return Receipt

You'll save a tremendous amount of agony, frustration, doubt, and most importantly - time - to get the funding your business deserves!

Don't sit around and wait to hear from the SBA. Take action now and get prepared. If you fail to plan... you plan to fail. Your business is counting on you to make the right decision.

We can achieve this because:

- Our online loan form generator streamlines the entire process and guides you step-by-step

- Our Systematic Checklist ensures you've prepared all required documents

- Our experts and decades of experience dealing with SBA and government agency – This isn't our first rodeo; we have gone through a similar process during the mortgage crisis of 2008 and helped countless small businesses prosper

Get immediate help from our team of experts to expedite your loan processing and get approved

Ensure You Get Your Share of the $2 Trillion Disaster Relief Package

Put Our Decades of Experience and Proprietary Process To Work For You Today - and Get Your Funding Faster!

OPTION 1

Full Service

We do it all for you for a fee permitted by SBA of $2,500 that would entail our EIDL team of experts to fill out all necessary application and forms to ensure your loan package is accurate, complete, and ready for immediate processing and approval.

All you have to do is to provide us with your tax returns, balance sheets, income (profit and loss) statements and bank statements.

OPTION 2

Do-it-Yourself

Using our Online Disaster Loan Form Generator for $449 that will guide you through the complex process every step of the way in a secure environment and assists you in answering the 400+ questionsrequired to complete the application and assemble your disaster loan package. We help make sure that you send in the correct and complete package the very first time saving you time, money and frustration.

- Step-by-step instruction

- Produces all required SBA forms for you

- System cross-checking for accuracy Takes 20 minutes instead of days

- Secure and private client portal

- Providing Complete checklist of documents to follow and submit

- Hardship letter template to support your request

- Guides you on where to submit your disaster loan package (online, fax and certified mail)

Frequently Asked Questions

Latest News and Updates:

Expert Help and Guidance For Small Businesses During The Covid-19 Pandemic

How to Get Your EIDL Loan Processed Faster with Less Stress and Confusion